How Much Is Property Tax In Texas Vs California . What are property taxes based on?the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of 12.73 percent.

from printablemapforyou.com

to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates.when comparing the property tax rates between texas and california, texas has the higher property taxes of the two. Average house price by state $762,981 $305,497:

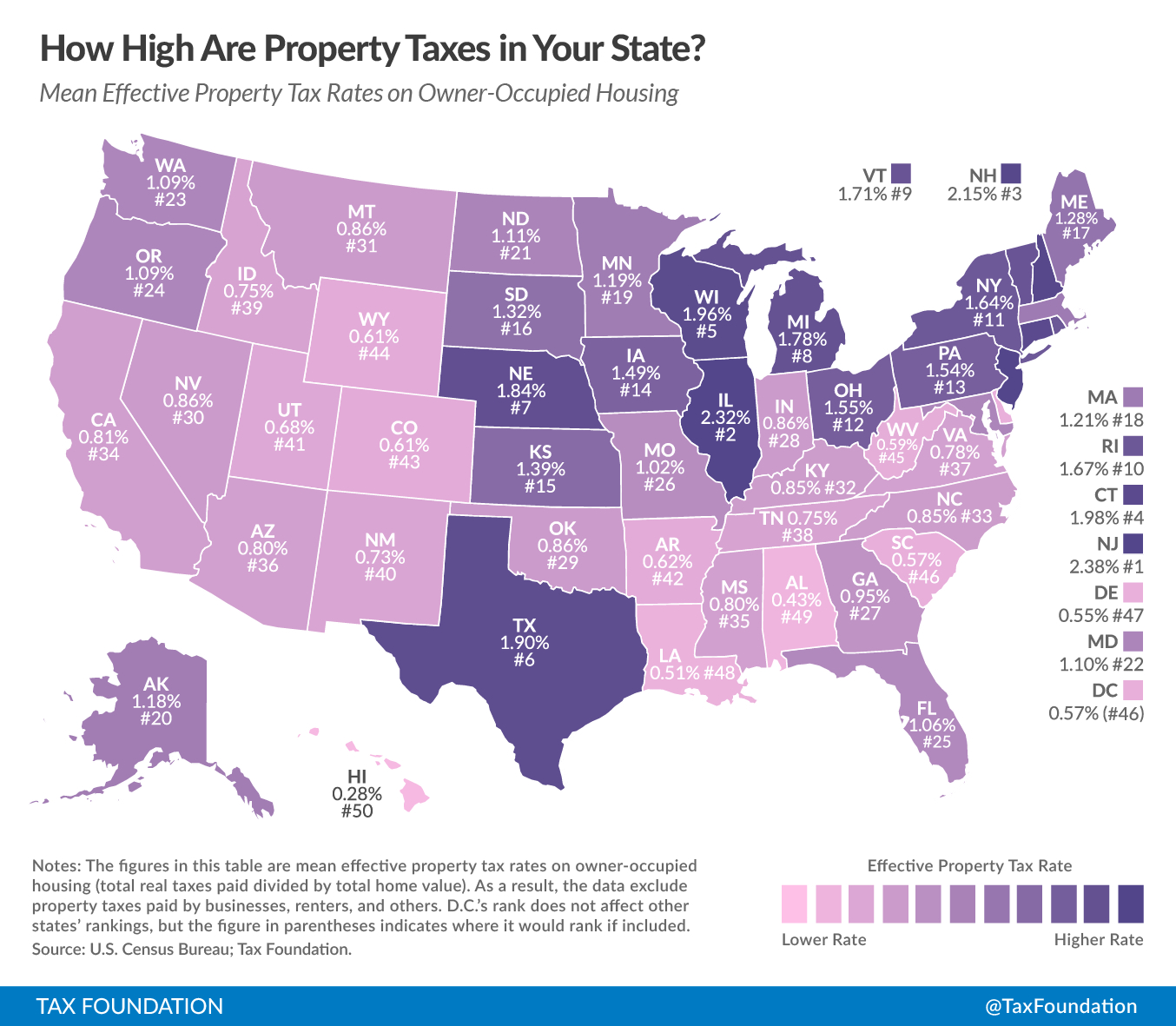

How High Are Property Taxes In Your State? Tax Foundation Texas

How Much Is Property Tax In Texas Vs California when comparing the property tax rates between texas and california, texas has the higher property taxes of the two.this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of 12.73 percent. While your home’s assessed value for property taxes may match its.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State How Much Is Property Tax In Texas Vs Californiawhen comparing the property tax rates between texas and california, texas has the higher property taxes of the two. Average house price by state $762,981 $305,497:the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of 12.73 percent.to calculate the exact amount of property tax. How Much Is Property Tax In Texas Vs California.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax How Much Is Property Tax In Texas Vs Californiato calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates.when comparing the property tax rates between texas and california, texas has the higher property taxes of the two. While your home’s assessed value for property taxes may match its.the difference in property taxes is. How Much Is Property Tax In Texas Vs California.

From sdrostra.com

California vs. Texas SMACKDOWN! SD Rostra How Much Is Property Tax In Texas Vs California Average house price by state $762,981 $305,497:the difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of 12.73 percent.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. What are property taxes based on? While. How Much Is Property Tax In Texas Vs California.

From jabberwocking.com

Texas has lower taxes than California . . . for some people Kevin Drum How Much Is Property Tax In Texas Vs California Average house price by state $762,981 $305,497:to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates.this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.when comparing the property tax rates between texas and. How Much Is Property Tax In Texas Vs California.

From www.youtube.com

What month are property taxes due in Texas? YouTube How Much Is Property Tax In Texas Vs Californiato calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. Average house price by state $762,981 $305,497:when comparing the property tax rates between texas and california, texas has the higher property taxes of the two.the difference in property taxes is one of the most. How Much Is Property Tax In Texas Vs California.

From texasscorecard.com

Where Does Texas Rank on Property Taxes? Texas Scorecard How Much Is Property Tax In Texas Vs Californiathe difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of 12.73 percent. What are property taxes based on?this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.to calculate the exact amount of property tax. How Much Is Property Tax In Texas Vs California.

From candysdirt.com

Texas Has the FifthHighest Property Taxes in the Nation, But Do We Get How Much Is Property Tax In Texas Vs Californiawhen comparing the property tax rates between texas and california, texas has the higher property taxes of the two.this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per. While your home’s assessed value for property taxes may match its. What are property taxes based on?the. How Much Is Property Tax In Texas Vs California.

From lao.ca.gov

Understanding California’s Property Taxes How Much Is Property Tax In Texas Vs California While your home’s assessed value for property taxes may match its. Average house price by state $762,981 $305,497:to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates.this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882. How Much Is Property Tax In Texas Vs California.

From www.austinrealestatehomesblog.com

How Much are Property Taxes in Austin Property Tax Rate How Much Is Property Tax In Texas Vs California While your home’s assessed value for property taxes may match its.when comparing the property tax rates between texas and california, texas has the higher property taxes of the two.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. What are property taxes based on? Average. How Much Is Property Tax In Texas Vs California.

From countyprogress.com

Biennial Property Tax Report Texas County Progress How Much Is Property Tax In Texas Vs Californiato calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. What are property taxes based on?this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per. While your home’s assessed value for property taxes may match its.. How Much Is Property Tax In Texas Vs California.

From canvas-tools.blogspot.com

Taxes In Austin Texas canvastools How Much Is Property Tax In Texas Vs California Average house price by state $762,981 $305,497: While your home’s assessed value for property taxes may match its.this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.when comparing the property tax rates between texas and california, texas has the higher property taxes of the two. Web. How Much Is Property Tax In Texas Vs California.

From www.youtube.com

Texas VS California How Do They Compare? YouTube How Much Is Property Tax In Texas Vs Californiato calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates.when comparing the property tax rates between texas and california, texas has the higher property taxes of the two. Average house price by state $762,981 $305,497: What are property taxes based on?this difference is entirely. How Much Is Property Tax In Texas Vs California.

From arizonarealestatenotebook.com

Arizona property taxes are much lower than in California, Florida or How Much Is Property Tax In Texas Vs California Average house price by state $762,981 $305,497:this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.when comparing the property tax rates between texas and california, texas has the higher property taxes of the two.the difference in property taxes is one of the most important. How Much Is Property Tax In Texas Vs California.

From gilottedesign.blogspot.com

California Property Tax Increase How Much Is Property Tax In Texas Vs Californiathis difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. What are property taxes based on? Average house price by state $762,981 $305,497:when comparing the. How Much Is Property Tax In Texas Vs California.

From www.pinterest.com

How Much Does Your State Collect in Sales Taxes Per Capita? Fortyfive How Much Is Property Tax In Texas Vs Californiato calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. What are property taxes based on? Average house price by state $762,981 $305,497:this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.the difference in. How Much Is Property Tax In Texas Vs California.

From lao.ca.gov

Understanding California’s Property Taxes How Much Is Property Tax In Texas Vs California What are property taxes based on?to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates.this difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per. While your home’s assessed value for property taxes may match its.. How Much Is Property Tax In Texas Vs California.

From www.pinterest.com

Sales Tax by State Here’s How Much You’re Really Paying Sales tax How Much Is Property Tax In Texas Vs Californiathis difference is entirely explained by income taxes with the sum of individual and corporate income taxes at $2,882 per.to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. Average house price by state $762,981 $305,497: While your home’s assessed value for property taxes may match. How Much Is Property Tax In Texas Vs California.

From www.motherjones.com

Taxes Are Surprisingly Similar in Texas and California Mother Jones How Much Is Property Tax In Texas Vs Californiathe difference in property taxes is one of the most important factors in giving texas an effective overall tax rate of 12.73 percent. What are property taxes based on? Average house price by state $762,981 $305,497:to calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates. Web. How Much Is Property Tax In Texas Vs California.